High Frequency Trading (HFT) covers such a broad swathe of 'trading' and financial markets that Mark Cuban (yes, that Mark Cuban), who has been among the leading anti-HFT graft voices in the public realm, decided to put finger-to-keyboard to create an "idiots guide to HFT" as a starting point for broad discussion. With screens full of desperate "stocks aren't rigged" HFT defenders seemingly most confused about what HFT is and does, perhaps instead of 'idiots' a better term would be "practitioners."

Via Blog Maverick,

First, let me say what you read here is going to be wrong in several ways. HFT covers such a wide path of trading that different parties participate or are impacted in different ways. I wanted to put this out there as a starting point . Hopefully the comments will help further educate us all

1. Electronic trading is part of HFT, but not all electronic trading is high frequency trading.

Trading equities and other financial instruments has been around for a long time. it is Electronic Trading that has lead to far smaller spreads and lower actual trading costs from your broker. Very often HFT companies take credit for reducing spreads. They did not. Electronic trading did.

We all trade electronically now. It’s no big deal

2. Speed is not a problem

People like to look at the speed of trading as the problem. It is not. We have had a need for speed since the first stock quotes were communicated cross country via telegraph. The search for speed has been never ending. While i dont think co location and sub second trading adds value to the market, it does NOT create problems for the market

3. There has always been a delta in speed of trading.

From the days of the aforementioned telegraph to sub milisecond trading not everyone has traded at the same speed. You may trade stocks on a 100mbs broadband connection that is faster than your neighbors dial up connection. That delta in speed gives you faster information to news, information, research, getting quotes and getting your trades to your broker faster.

The same applies to brokers, banks and HFT. THey compete to get the fastest possible speed. Again the speed is not a problem.

4. So what has changed ? What is the problem

What has changed is this. In the past people used their speed advantages to trade their own portfolios. They knew they had an advantage with faster information or placing of trades and they used it to buy and own stocks. If only for hours. That is acceptable. The market is very darwinian. If you were able to figure out how to leverage the speed to buy and sell stocks that you took ownership of , more power to you. If you day traded in 1999 because you could see movement in stocks faster than the guy on dial up, and you made money. More power to you.

What changed is that the exchanges both delivered information faster to those who paid for the right AND ALSO gave them the ability via order types where the faster traders were guaranteed the right to jump in front of all those who were slower (Traders feel free to challenge me on this) . Not only that , they were able to use algorithms to see activity and/or directly see quotes from all those who were even milliseconds slower.

With these changes the fastest players were now able to make money simply because they were the fastest traders. They didn’t care what they traded. They realized they could make money on what is called Latency Arbitrage. You make money by being the fastest and taking advantage of slower traders.

It didn’t matter what exchanges the trades were on, or if they were across exchanges. If they were faster and were able to see or anticipate the slower trades they could profit from it.

This is where the problems start.

If you have the fastest access to information and the exchanges have given you incentives to jump in front of those users and make trades by paying you for any volume you create (maker/taker), then you can use that combination to make trades that you are pretty much GUARANTEED TO MAKE A PROFIT on.

[ZH:

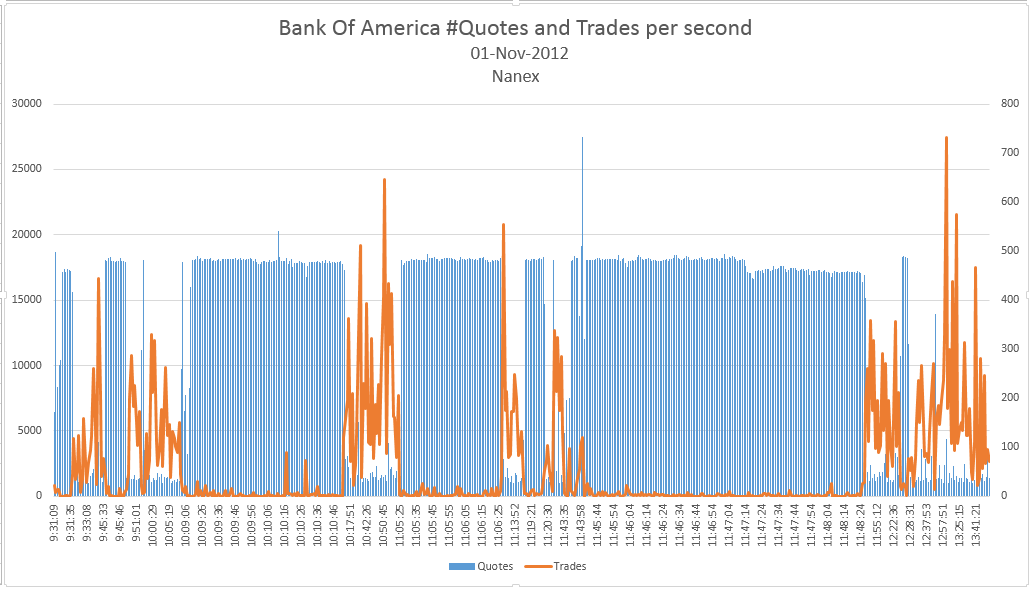

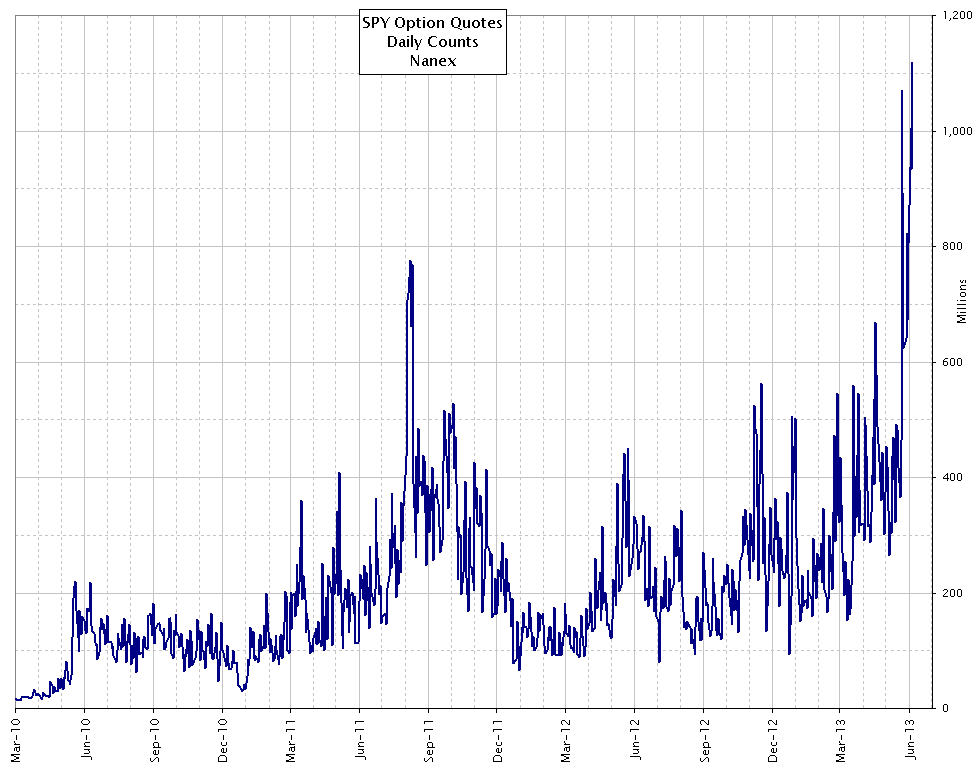

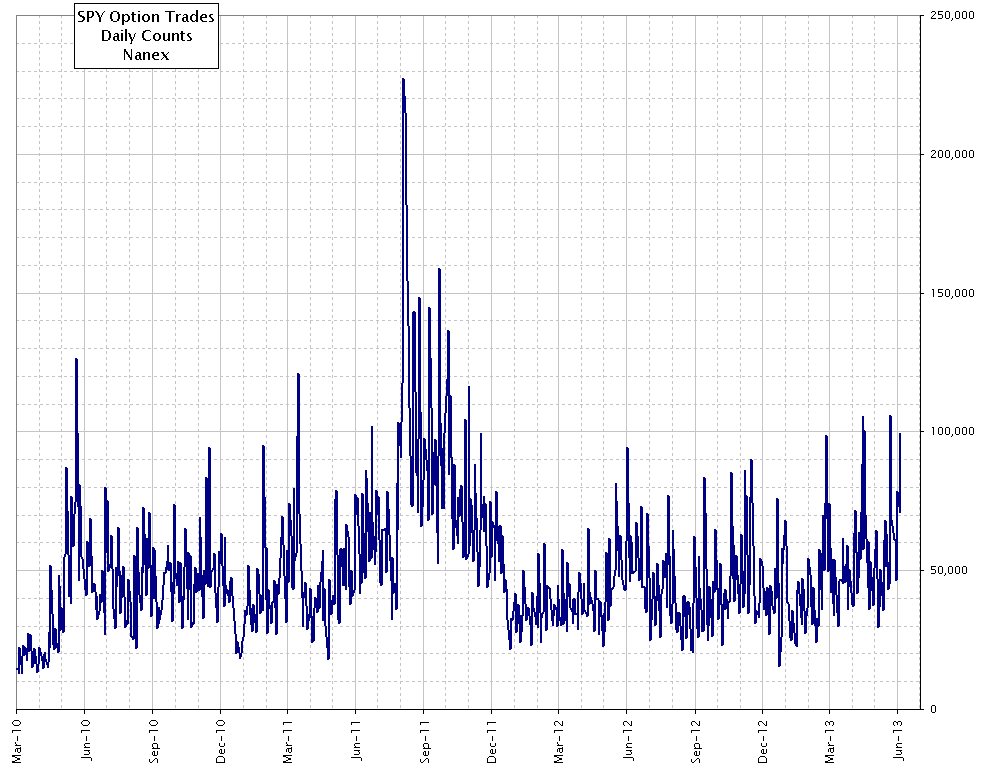

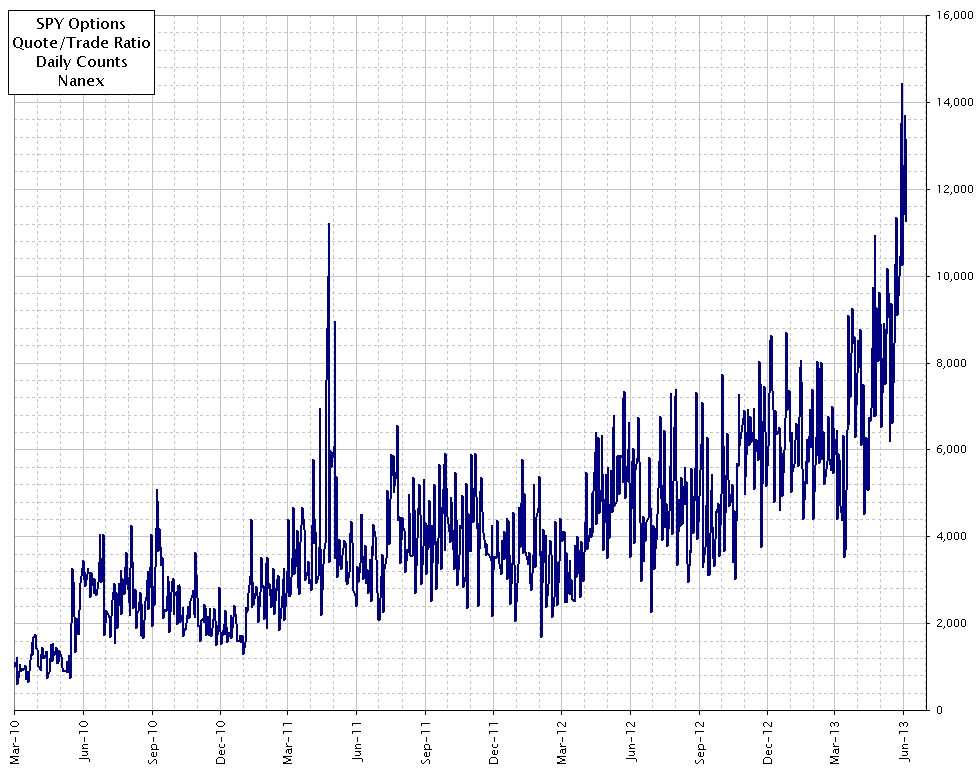

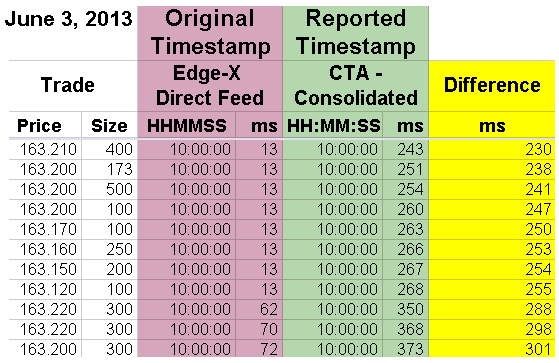

And here is Nanex with the clearest example of just what the difference between the 'slow' consolidated SIP feed (that BATS CEO lied about using) and fast 'Direct' feed (that BATS actually uses enabling HFT to skim as seen below) means...

The trade time-stamps in the consolidated feed are not the original time-stamps shown in expensive direct feeds used by High Frequency Traders (HFT). The time-stamps are getting replaced right before they are transmitted to subscribers from the SIP (security information processor, which creates the consolidated feed). This means direct feed subscribers are getting more accurate core market data than consolidated subscribers: a direct Reg NMS violation.

![]()

The loss of original time-stamps makes it difficult to reconstruct accurate audit trails or make comparisons to quote data. It also renders any computations based on trade data (e.g. charts, technical analysis) inaccurate.

We matched a few seconds of SPY trades on June 3, 2013 from a direct feed (Edge-X) to the same trades from the consolidated feed. In the selection shown in the image on the right, the first trade (163.21 and 400 shares) has a time-stamp of 10:00:00.013 in the direct feed and a time-stamp of 10:00:00.243 in the consolidated feed, a difference of 230 milliseconds!

![]()

Download the complete list (pdf).

See this paper for more charts and data on this event.

Ironic that the two versions of the same reality are "blue" and "red" in this chart... which pill will you swallow?]

So basically, the fastest players, who have spent billions of dollars in aggregate to get the fastest possible access are using that speed to jump to the front of the trading line. They get to see , either directly or algorithmically the trades that are coming in to the market.

When I say algorithmically, it means that firms are using their speed and their brainpower to take as many data points as they can use to predict what trades will happen next. This isn’t easy to do. It is very hard. It takes very smart people. If you create winning algorithms that can anticipate/predict what will happen in the next milliseconds in markets/equities, you will make millions of dollars a year. (Note:not all algorithms are bad. Algorithms are just functions. What matters is what their intent is and how they are used)

These algorithms take any number of data points to direct where and what to buy and sell and they do it as quickly as they can. Speed of processing is also an issue. To the point that there are specialty CPUs being used to process instruction sets. In simple terms, as fast as we possibly can, if we think this is going to happen, then do that.

The output of the algorithms , the This Then That creates the trade (again this is a simplification, im open to better examples) which creates a profit of some relatively small amount. When you do this millions of times a day, that totals up to real money . IMHO, this is the definition of High Frequency Trading. Taking advantage of an advantage in speed and algorithmic processing to jump in front of trades from slower market participants to create small guaranteed wins millions of times a day. A High Frequency of Trades is required to make money.

There in lies the problem. This is where the game is rigged.

If you know that by getting to the front of the line you are able to see or anticipate some material number of the trades that are about to happen, you are GUARANTEED to make a profit. What is the definition of a rigged market ? When you are guaranteed to make a profit. In casino terms, the trader who owns the front of the line is the house. The house always wins.

So when Michael Lewis and others talk about the stock market being rigged, this is what they are talking about. You can’t say the ENTIRE stock market is rigged, but you can say that for those equities/indexs where HFT plays, the game is rigged so that the fastest,smart players are guaranteed to make money.

6. Is this bad for individual investors ?

If you buy and sell stocks, why should you care if someone takes advantage of their investment in speed to make a few pennies from you ? You decide, but here is what you need to know:

a. Billions of dollars has been spent to get to the front of the line. All of those traders who invested in speed and expensive algorithm writers need to get a return on their investment. They do so by jumping in front of your trade and scalping just a little bit. What would happen if they weren’t there ? There is a good chance that whatever profit they made by jumping in front of your trade would go to you or your broker/banker.

b. If you trade in small stocks, this doesn’t impact small stock trades. HFT doesn’t deal with low volume stocks. By definition they need to do a High Frequency of Trades. If the stocks you buy or sell don’t have volume (i dont know what the minimum amount of volume is), then they aren’t messing with your stocks

c. Is this a problem of ethics to you and other investors ? If you believe that investors will turn away from the market because they feel that it is ethically wrong for any part of the market to offer a select few participants a guaranteed way to make money, then it could create significant out flows of investors cash which could impact your net worth. IMHO, this is why Schwab and other brokers that deal with retail investors are concerned. They could use customers.

7. Are There Systemic Risks That Result From All of This.

The simple answer is that I personally believe that without question the answer is YES. Why ?

If you know that a game is rigged AND that it is LEGAL to participate in this rigged game, would you do everything possible to participate if you could ?

Of course you would. But this isn’t a new phenomena. The battle to capture all of this guaranteed money has been going on for several years now. And what has happened is very darwinian. The smarter players have risen to the top. They are capturing much of the loot. It truly is an arms race. More speed gives you more slots at the front of the lines. So more money is being spent on speed.

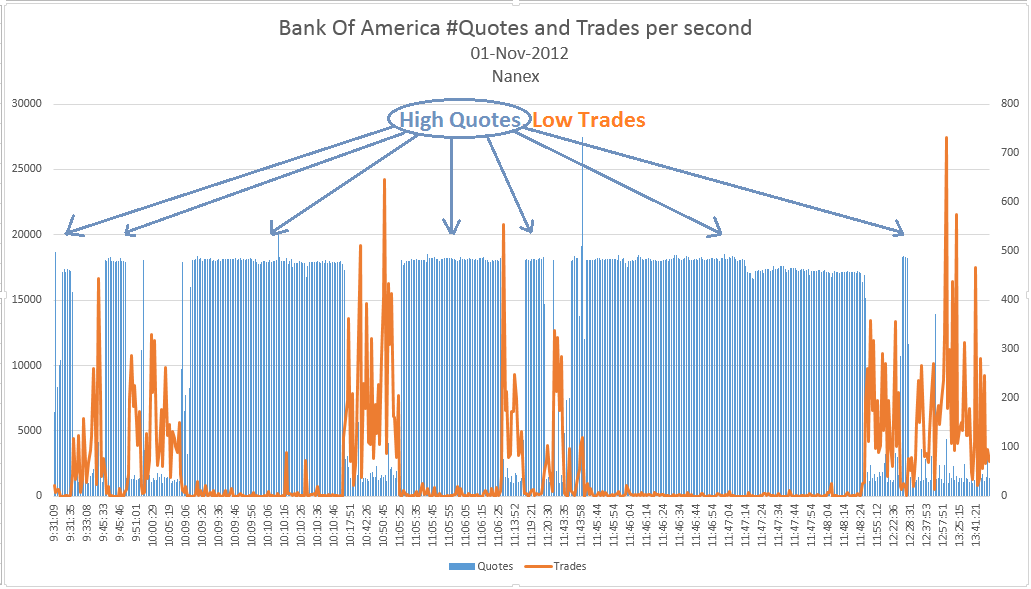

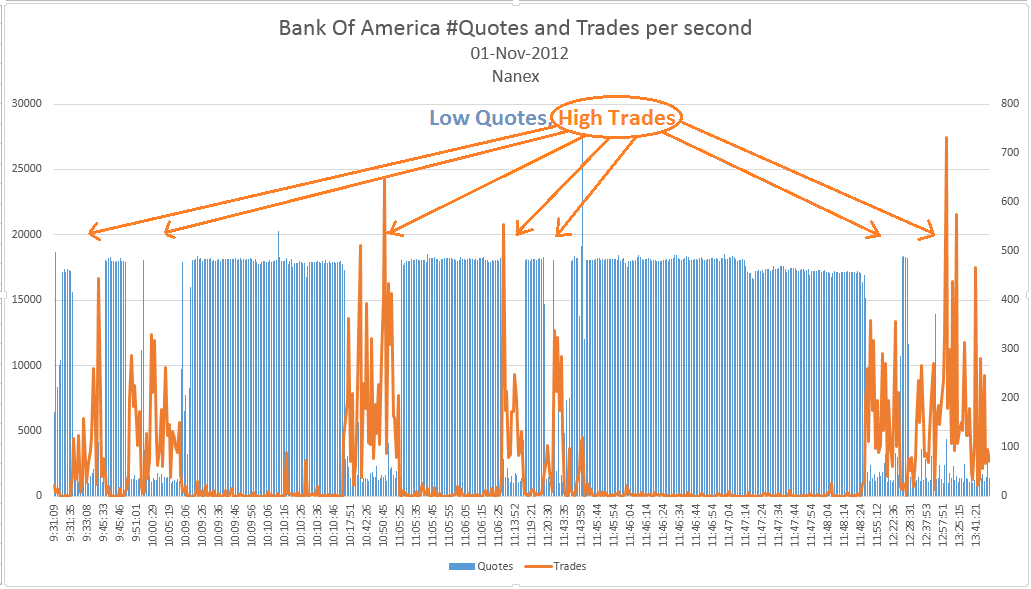

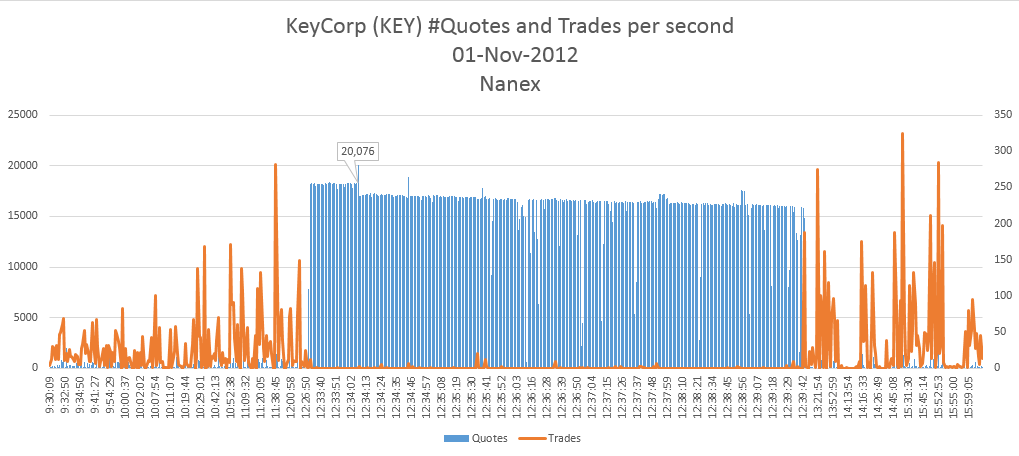

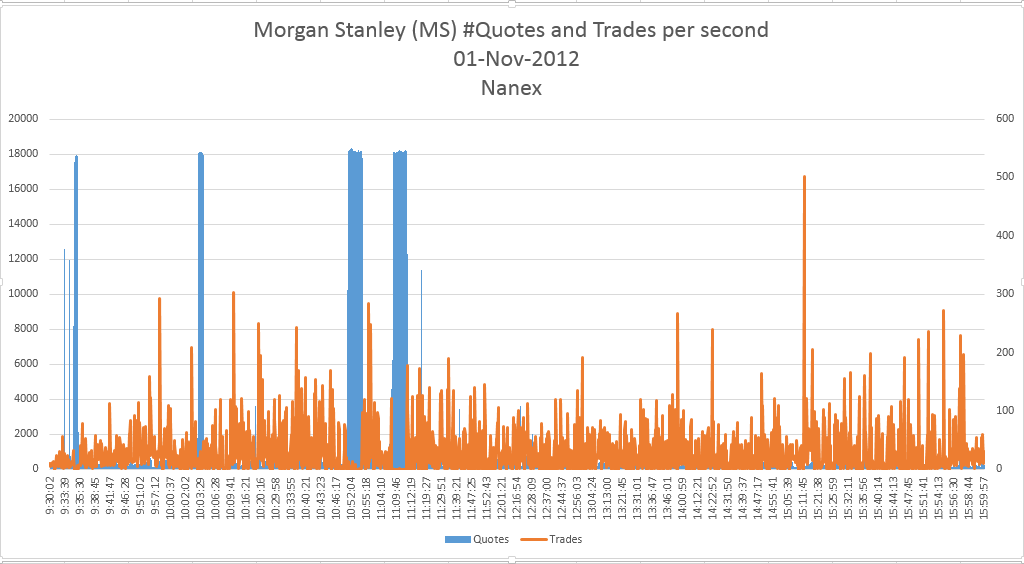

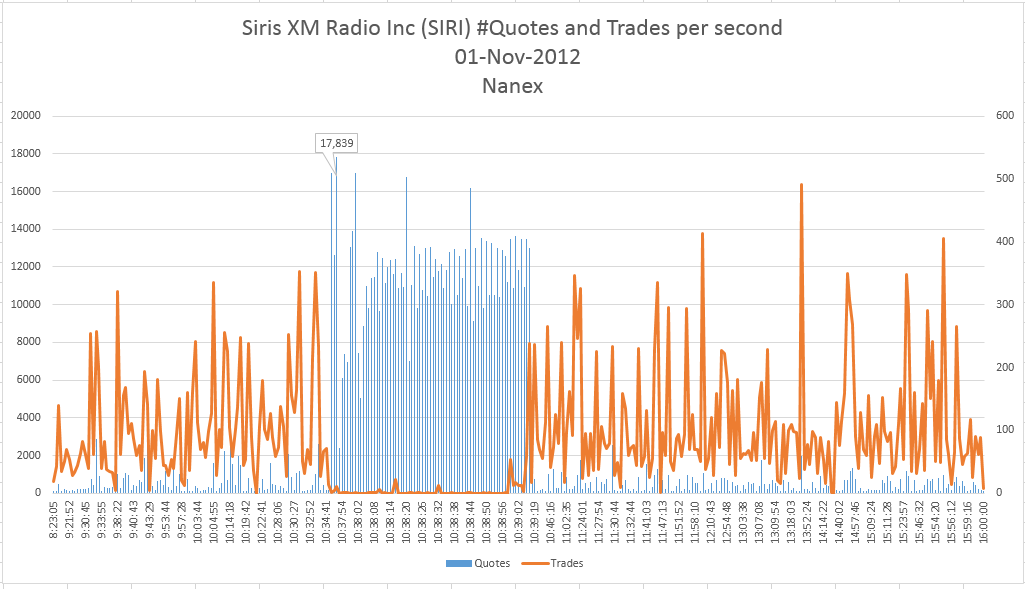

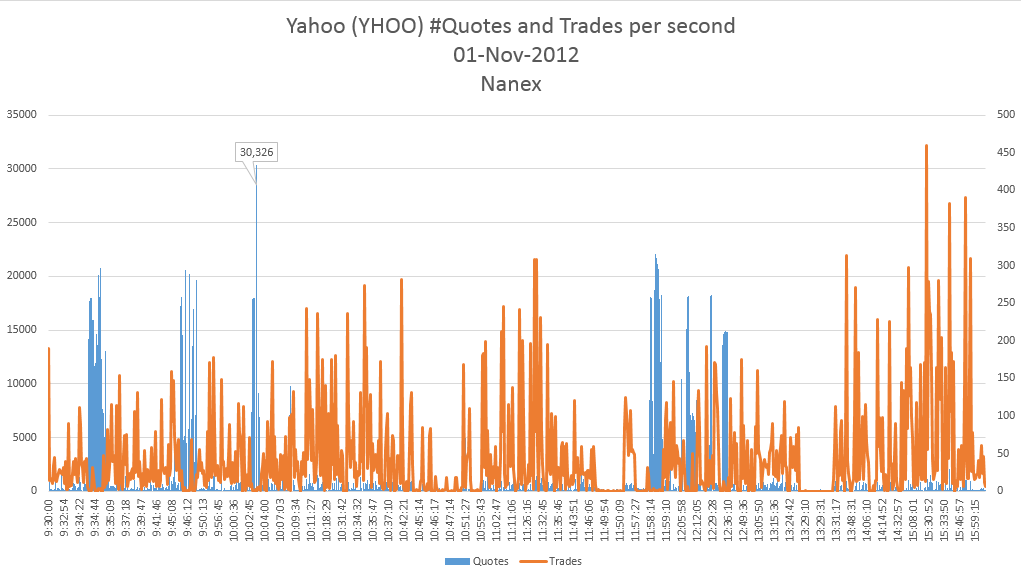

Money is also being spent on algorithms. You need the best and brightest in order to write algorithms that make you money. You also need to know how to influence markets in order to give your algorithms the best chance to succeed. There is a problem in the markets known as quote stuffing. This is where HFT create quotes that are supposed to trick other algorithms , traders, investors into believing their is a true order available to be hit. In reality those are not real orders. They are decoys. Rather than letting anyone hit the order, because they are faster than everyone else, they can see your intent to hit the order or your reaction either directly or algorithmically to the quote and take action. And not only that, it creates such a huge volume of information flow that it makes it more expensive for everyone else to process that information, which in turn slows them down and puts them further at a disadvantage.

IMHO, this isn’t fair. It isn’t a real intent. At it’s heart it is a FRAUD ON THE MARKET. There was never an intent to execute a trade. It is there merely to deceive.

But Order Stuffing is not the only problem.

Everyone in the HFT business wants to get to the front of the line. THey want that guaranteed money. In order to get there HFT not only uses speed, but they use algorithms and other tools (feel free to provide more info here HFT folks) to try to influence other algorithms. It takes a certain amount of arrogance to be good at HFT. If you think you can out think other HFT firms you are going to try to trick them into taking actions that cause their algorithms to not trade or to make bad trades. It’s analogous to great poker players vs the rest of us.

What we don’t know is just how far afield HFT firms and their algorithms will go to get to the front of the line. There is a moral hazard involved. Will they take risks knowing that if they fail they may lose their money but the results could also have systemic implications ?. We saw what happened with the Flash Crash. Is there any way we can prevent the same thing from happening again ? I don’t think so. Is it possible that something far worse could happen ? I have no idea. And neither does anyone else

It is this lack of ability to quantify risks that creates a huge cost for all of us. Warren Buffet called derivatives weapons of mass destruction because he had and has no idea what the potential negative impact of a bad actor could be. The same problem applies with HFT. How do we pay for that risk ? And when ?

When you have HFT algorithms fighting to get to the front of the line to get that guaranteed money , who knows to what extent they will take risks and what they impact will be not only on our US Equities Markets, but also currencies, foreign markets and ? ? ?

What about what HFT players are doing right now outside of US markets ? All markets are correlated at some level. Problems outside the US could create huge problems for us here.

IMHO, there are real systemic issues at play.

8. So Why are some of the Big Banks and Funds not screaming bloody murder ?

To use a black jack analogy , its because they know how to count cards. They have the resources to figure out how to match the fastest HFT firms in their trading speeds. They can afford to buy the speed or they can partner with those that can. They also have the brainpower to figure out generically how the algorithms work and where they are scalping their profits. By knowing this they can avoid it. And because they have the brain power to figure this out, they can actually use HFT to their advantage from time to time. Where they can see HFT at work, they can feed them trades which provides some real liquidity as opposed to volume.

The next point of course is that if the big guys can do it , and the little guys can let the big guys manage their money , shouldn’t we all just shut up and work with them ? Of course not. We shouldn’t have to invest with only the biggest firms to avoid some of the risks of HFT. We should be able to make our decisions as investors to work with those that give us the best support in making investments. Not those who have the best solution to outsmarting HFT.

But more importantly, even the biggest and smartest of traders , those who can see and anticipate the HFT firms actions can’t account for the actions of bad actors. They can’t keep up with the arms race to get to the front of the line. Its not their core competency. It is a problem for them, but they also know that by being able to deal with it better than their peers, it gives them a selling advantage. “We can deal with HFT no problem”. So they aren’t screaming bloody murder.

9. So My Conclusion ?

IMHO, it’s not worth the risk. I know why there is HFT. I just don’t see why we let it continue. It adds no value. But if it does continue, then we should require that all ALGORITHMIC players to register their Algorithms. While I’m not a fan of the SEC, they do have smart players at their market structure group. (the value of going to SEC Speaks :). While having copies of the algorithms locked up at the SEC wont prevent a market collapse/meltdown, at least we can reverse engineer it if it happens.

I know this sounds stupid on its face. Reverse engineer a collapse ? But that may be a better solution than expecting the SEC to figure out how to regulate and pre empt a market crash

10…FINAL FINAL THOUGHTS

I wrote this in about 2 hours. Not because i thought it would be definitive or correct. I expect to get ABSOLUTELY CRUSHED on many points here. But there is so little knowledge and understanding of what is going on with HFT, that I believed that someone needed to start the conversation